What Features Does the Process of Producing Palm Oil Have?

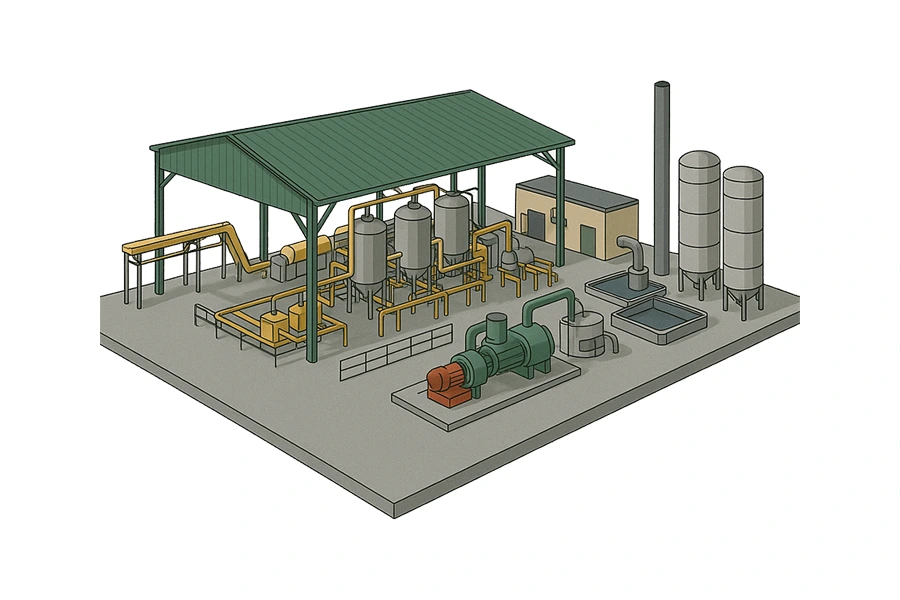

Palm oil is a widely used, high-yield vegetable oil found in food, cosmetics, and fuels. Its production involves complex steps requiring quality control and environmental compliance. This article outlines the key stages, technologies, and environmental considerations that define the palm oil production process. High Oil Yield from Fruit Bunches A standout feature of palm oil production is its extremely high oil yield per hectare. A single oil palm tree can produce fresh fruit bunches (FFBs) year-round, with each bunch containing hundreds to thousands of individual fruits. Oil-rich parts: The fruit mesocarp yields crude palm oil, while the kernel (seed) yields palm kernel oil (PKO). Efficiency: Compared to other oil crops like soybeans or sunflower seeds, oil palm produces up to ten times as much oil per hectare. Palm oil is very sought-after for extensive industrial and agricultural use due to its high productivity. Short Harvest-to-Processing Timeframe Palm oil production process is extremely time-sensitive. After harvesting, FFBs must be processed within 24 to 48 hours to prevent the build-up of free fatty acids (FFAs), which degrade oil quality. Rapid processing is critical: Delays can lead to rancid oil with poor flavor and shelf life. Integrated mills: Many plantations have integrated palm oil mills to minimize transport time and preserve oil quality. This urgency shapes much of the logistics and infrastructure around palm oil production. Mechanical and Thermal Processing Techniques The palm oil extraction process combines mechanical and thermal methods. The goal is to separate the oil from the fibrous fruit structure while preserving its chemical integrity. Main processing stages: Sterilization: FFBs are steamed under pressure to kill enzymes and soften fruit. Threshing: Fruit is separated from the bunch stalk mechanically. Digesting: Fruit is heated and mashed to release oil. Pressing: Oil is extracted using screw presses. Clarification: Settling tanks or centrifuges are used to separate crude oil from particulates and water. Kernel recovery: Seeds are cracked and processed separately to extract palm kernel oil. Each stage is engineered to maximize oil yield while minimizing damage and contamination. Distinct Crude and Refined Product Streams Palm oil processing results in two main oil products: Fruit flesh is the source of crude palm oil (CPO). Because of its high beta-carotene content, it has a reddish-orange color and is semi-solid at room temperature. Palm Kernel Oil (PKO): Taken out of the kernel. It is lighter in color and more similar to coconut oil in fatty acid profile. Both oils undergo refining to remove impurities, odor, and color, yielding products suited for food, cosmetics, and industrial applications. Energy-Intensive Yet Self-Sustaining Palm oil mills consume significant energy, primarily for sterilization, digestion, and oil extraction. Nonetheless, this industry’s potential for energy self-sufficiency makes it special: Biomass fuel: The process generates large volumes of biomass waste—shells, fibers, and empty bunches—which can be burned to produce steam and electricity. Biogas: Palm Oil Mill Effluent (POME), rich in organic material, can be digested anaerobically to produce methane for energy. Many modern mills operate with minimal external energy input, improving sustainability and reducing operational costs. Generation of Valuable Byproducts Beyond oil, the palm oil production process yields a variety of valuable byproducts: Palm kernel cake (PKC): The residue after PKO extraction, used as animal feed. Empty fruit bunches (EFB): Used as compost or boiler fuel. POME: Can be treated for biogas generation or used as organic fertilizer after proper treatment. These byproducts contribute to the economic and environmental sustainability of the industry when managed properly. Environmental Sensitivities and Waste Management Challenges Palm oil production has faced criticism for deforestation, biodiversity loss, and pollution. However, a key characteristic of the process is its potential for eco-friendly transformation if managed responsibly. Environmental aspects include: POME management: Must be treated before discharge due to high BOD and COD levels. Solid waste recycling: Shells and fibers can be used in energy production. Sustainable certification: Organizations like RSPO (Roundtable on Sustainable Palm Oil) provide frameworks for sustainable practices, including traceability and habitat protection. Environmental stewardship is increasingly integral to the process, particularly for exporters. Labor-Intensive with Increasing Mechanization Traditionally, harvesting and handling of FFBs are labor-intensive. Tall palms must have their bunches manually chopped before being transported to collection locations. However, there is a growing push toward: Mechanized harvesting tools Automated threshers and digester machines Computerized controls in modern mills Automation is improving productivity and consistency, especially in large plantations with high throughput. Quality Control Throughout the Process Strict oversight is necessary at every stage of manufacturing to guarantee the quality of palm oil: FFB ripeness: Only ripe fruits produce quality oil. Temperature control: Overheating can degrade oil; underheating reduces yield. FFA content: Must be monitored to avoid rancidity. Color and odor: Indicators of oil purity and suitability for specific applications. Many mills use sensors and on-site labs to ensure traceability and quality criteria are met. Significant Water Use and Need for Treatment Systems Palm oil production is water-intensive. Water is used in sterilization, clarification, and kernel recovery. The wastewater generated—POME—poses serious environmental risks if discharged untreated. Water management includes: Effluent treatment plants (ETPs): To remove organic load. Water recycling systems: Reduce consumption and minimize waste. Rainwater harvesting and conservation practices: Becoming common in eco-conscious mills. Water footprint optimization is a growing focus in sustainable operations. Tropical Crop Dependency and Climate Sensitivity Palm oil production is highly dependent on tropical climates, with ideal growing conditions found in Southeast Asia, Africa, and Latin America. Key climate characteristics: High rainfall (1,800–4,000 mm/year) Consistent sunlight Warm temperatures (25–30°C) This makes palm oil cultivation vulnerable to climate change effects such as droughts, floods, and shifting rainfall patterns, which in turn affect processing timelines and yields. Supply Chain Integration and Traceability Modern palm oil operations increasingly integrate plantation management with processing, refining, and logistics. This integration allows: Shorter harvest-to-mill time Better traceability for sustainability certification Consistency in quality and supply Digital tracking systems and blockchain are being explored to improve transparency from farm to final product. Compliance with Food Safety and Export Standards As palm oil enters the global food supply