As sustainability demands rise, palm oil processing plants face pressure to cut emissions and improve energy efficiency. Meanwhile, the expanding carbon market offers strong financial incentives for companies that can verify GHG reductions—creating a valuable opportunity for palm oil mills to generate and sell carbon credits. Since mills produce methane-rich effluent, biomass residues, and energy-intensive steam, they are well positioned to reduce emissions and profit. This article explores how palm oil plants can leverage carbon credits, which technologies enable them, and how mills in Africa and Asia can turn sustainability into revenue.

Comprehending Carbon Credits

Carbon Credits: What Are They?

A carbon credit represents one metric ton of CO₂-equivalent emissions reduced, avoided, or removed from the atmosphere. Companies or governments purchase these credits to offset their own emissions.

Palm oil processing plants can generate credits when they:

- Capture methane from POME (Palm Oil Mill Effluent)

- Convert biomass into renewable energy

- Improve energy efficiency

- Reduce diesel or grid electricity consumption

These reductions must be verified against international standards.

Voluntary vs Compliance Markets

| Market Type | Who Buys Credits | Examples | Relevance to Palm Oil Mills |

| Voluntary Carbon Markets (VCM) | Corporations with ESG goals | Tech, food, logistics companies | Highest potential; palm mills commonly register here |

| Compliance Markets | Regulated industries | EU ETS, California Cap-and-Trade | Less common but emerging in some countries |

Most palm oil carbon projects sell into voluntary markets due to simpler registration and a wider buyer base.

How Carbon Credits Are Generated

A project must meet three requirements:

- Baseline – Establish what emissions would have occurred without action

- Additionality – Prove the reduction would not happen without the project

- Verification – Third-party auditors confirm the reduction

Standards include:

- Verra (VCS)

- Gold Standard

- UN CDM

- ISCC (for supply chain emission reductions)

Emissions Sources in Palm Oil Processing Plants

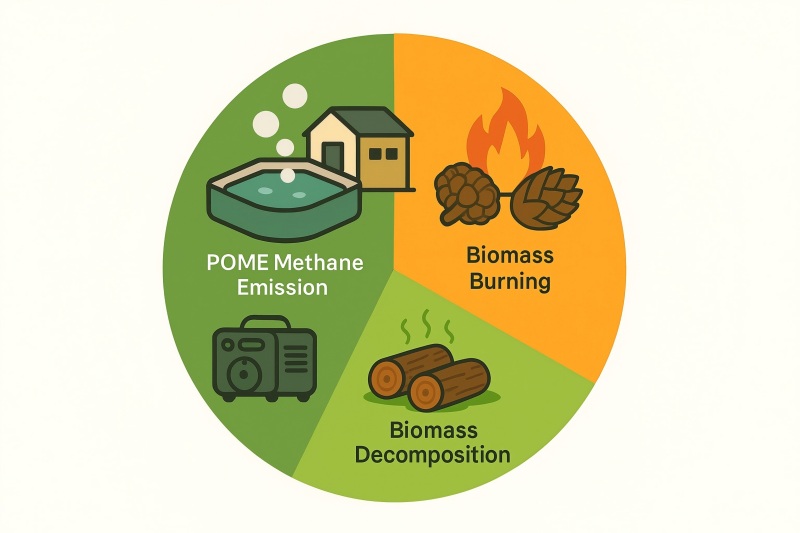

Palm oil processing plants generate multiple types of emissions, especially from waste and energy use.

Major GHG Sources

- POME Methane Emissions

Palm Oil Mill Effluent naturally produces methane during anaerobic decomposition.

Methane (CH₄) is 28–34 times more potent than CO₂.

This is the largest emission source in most mills.

- Biomass Burning

Fibers and shells used as fuel can emit CO₂ and particulates if burned inefficiently.

- Diesel and Electricity Use

Diesel generators, transport trucks, and electricity for boilers contribute to emissions.

- Waste Biomass Decomposition

Empty fruit bunches (EFB) and biomass piles release methane as they decay.

Why Palm Oil Mills Have High Carbon Credit Potential

Palm oil mills can reduce emissions through technology that is:

- Proven and commercially available

- Relatively low-cost compared to other industries

- Highly scalable (hundreds of mills across Nigeria, Indonesia, Malaysia, Ghana, Colombia, etc.)

This creates reliable, measurable emission reductions—ideal for carbon credit certification.

Carbon Reduction Strategies for Palm Oil Processing Plants

Below are the main pathways palm oil plants can use to generate carbon credits.

POME Methane Capture & Biogas Systems

Capturing methane from POME is the single biggest opportunity.

Technologies include:

- Covered lagoons

Low-cost and suitable for developing regions.

- Anaerobic digesters (CSTR, UASB, plug-flow)

Higher efficiency → more methane → more carbon credits.

- Biogas-to-Electricity Systems

Generate steam, electricity, or both (cogeneration).

Benefits:

- Large emission reductions

- Additional renewable energy source

- Stable credit output for 10–21 years

Biomass Utilization

Palm oil mills generate 5–7 tons of biomass per ton of crude palm oil (CPO).

Carbon credit opportunities:

- EFB briquettes/pellets replacing coal

- Palm kernel shell (PKS) as an industrial fuel

- Biochar production with carbon sequestration

- Organic composting systems reduce methane

Energy Efficiency Upgrades

- High-efficiency boilers

- Variable speed drives (VSD)

- Waste heat recovery

- Solar–biomass hybrid systems

- Modern mill automation

Each efficiency improvement reduces emissions and fuel consumption.

Reforestation & Agroforestry

Palm oil companies may implement:

- Riparian buffer restoration

- Smallholder agroforestry

- Rehabilitation of degraded land

These programs sequester carbon and may qualify for forestry credits.

How Carbon Credits Are Calculated for Palm Oil Mills

Baseline vs Project Emissions

| Emission Source | Baseline | After Project | Reduction |

| CH₄ from POME | 100,000 tCO₂e | 10,000 tCO₂e | 90,000 tCO₂e |

| Diesel generators | 20,000 tCO₂e | 8,000 tCO₂e | 12,000 tCO₂e |

| Grid electricity | 15,000 tCO₂e | 5,000 tCO₂e | 10,000 tCO₂e |

These reductions convert directly into carbon credits.

MRV: Monitoring, Reporting & Verification

Key data required:

- POME volume

- COD/BOD levels

- Methane captured

- Electricity generated

- Diesel consumption

- Biomass fuel usage

Certifiers verify this annually.

Expected Credit Ranges

| Project Type | Estimated Credits/Year |

| POME methane capture | 20,000–100,000 credits |

| Biogas electricity | 10,000–50,000 credits |

| Biomass-to-energy | 5,000–30,000 credits |

| Biochar | 2,000–40,000 credits |

A medium-sized palm oil mill can earn $100,000–$600,000 per year from carbon credits alone (depending on carbon price).

Financial Benefits of Carbon Credits for Palm Oil Plants

New Revenue Streams

Carbon credits can be sold to:

- Multinational corporations

- ESG-driven buyers

- Carbon brokers

- Carbon exchanges (AirCarbon, Gold Standard marketplace)

Price range: $3–$18 per credit, depending on quality.

Cost Reductions Through Renewable Energy

Biogas systems significantly reduce operational expenses:

- Biogas replaces diesel

- Steam from biogas reduces fiber/shell consumption

- On-site electricity reduces grid dependency

Increased Competitiveness

Low-carbon palm oil is increasingly demanded by:

- EU buyers

- U.S. food and cosmetics companies

- RSPO and ISCC supply chains

Carbon credits help achieve:

- Lower LCA emissions

- Higher ESG scores

- Access to premium markets

Access to Green Financing

Carbon credit projects attract:

- Green bonds

- International climate funds

- Low-interest loans

- Carbon-linked investment incentives

Banks prefer mills with long-term sustainability revenue.

How to Take Part in a Program for Carbon Credits

Conduct a Feasibility Study

Determine:

- Emission sources

- Potential reductions

- Suitable technologies

Choose a Project Developer

They manage:

- Documentation

- Registration

- Verification

- Credit sales

Select Certification Standard

Most mills choose:

- Verra (VCS) for biogas

- Gold Standard for community projects

Install MRV Systems

Sensors and monitoring tools must measure:

- Methane flow

- Electricity generation

- Fuel consumption

Register and Issue Credits

Annual verification leads to credit issuance.

Sell the Credits

Options:

- Broker

- Exchange

- Direct purchase agreements (highest price)

Common Challenges & Solutions

| Challenge | Solution |

| High upfront investment | Carbon-sharing EPC model |

| Complex documentation | Work with accredited developers |

| Market price fluctuations | Long-term credit sales contracts |

| Long verification times | Digital MRV technologies |

Future Outlook

Carbon markets in Africa and Southeast Asia are projected to grow rapidly as:

- Corporations commit to net-zero targets

- Developing nations introduce carbon frameworks

- Buyers prefer low-carbon palm oil

- Bioenergy policies encourage renewable power

Palm oil mills that invest early will become leaders in sustainable processing and green revenue generation.

Palm oil processing plants have one of the strongest opportunities in the agricultural sector to generate carbon credits. Through methane capture, biomass-to-energy systems, energy efficiency upgrades, and improved waste management, mills can significantly reduce emissions while creating new revenue streams.

Carbon credits not only improve plant profitability but also position producers for global sustainability markets, green financing opportunities, and long-term competitiveness.

Palm oil processors who act now will gain the greatest benefits as carbon markets continue to expand worldwide.