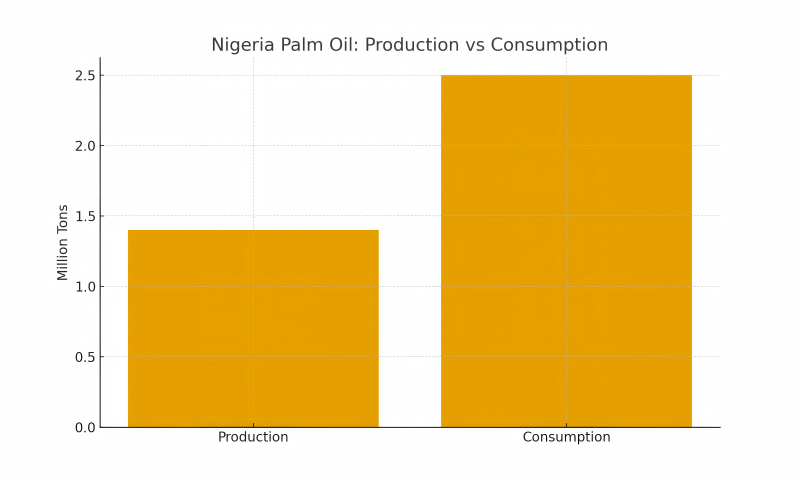

Palm oil powers global industries from food to cosmetics, and rising demand is pushing African nations to expand production. Nigeria consumes about 2.5 million tons yearly but produces only 1.4 million, creating a major supply gap and a strong investment opportunity. Below are six key reasons palm oil production in Nigeria is a smart move today.

Reason 1: Massive Domestic Demand Outstripping Local Supply

Nigeria is the largest consumer of palm oil in Africa, driven by population growth, urbanization, food manufacturing, and household usage.

Domestic Market Overview

Despite being a traditional palm oil producer, Nigeria cannot meet its own consumption demands and imports hundreds of thousands of tons each year. This situation automatically creates a stable, long-term market for new entrants.

For Investors

- High domestic prices due to supply shortages

- Lower risk of market saturation

- Reliable off-take opportunities from FMCG, soap manufacturers, and food processors

- Strong demand for both CPO (Crude Palm Oil) and PKO (Palm Kernel Oil)

For Equipment Manufacturers

The production gap highlights a massive modernization opportunity. Most smallholders still use manual or semi-mechanized equipment, producing poor-quality oil with high losses. Modern mills are in high demand.

Reason 2: Ideal Climate, Fertile Land & Underutilized Resources

Nigeria’s southern belt offers some of the best natural conditions for palm oil cultivation worldwide.

Climate Advantages

- High rainfall

- Strong sunshine

- Consistent humidity

- Rich, fertile soil

These factors support high yields with minimal artificial irrigation.

Land Availability

Large areas of fertile but unused or poorly used lands are accessible through:

- State agricultural leases

- Community partnerships

- Long-term concession agreements

- Reviving abandoned estates

For Investors

Hybrid seedlings now available can produce 20–30 tons of FFB per hectare, with short maturity cycles (3–4 years).

For Equipment Manufacturers

As new plantations grow, demand rises for:

- 1–30 TPH mills

- Kernel crushing plants

- Smallholder mini-mills for cooperatives

Every hectare planted eventually requires downstream processing capacity.

Reason 3: Strong Government Support & Incentives

Nigeria’s federal and state governments actively support agricultural industrialization.

Key Incentives Include:

- Low-interest loans through the CBN

- Tax holidays for agro-processing investors

- Duty waivers for palm oil processing machines

- Anchor Borrowers Programme for financing

- Grants for plantation rehabilitation

For Investors

These incentives significantly reduce CAPEX and speed up ROI timelines.

For Equipment Manufacturers

Policies mandating modernization directly expand the equipment market. More investors → more mills → more machinery needed.

Reason 4: High Profit Margins Across the Entire Value Chain

Palm oil is unique because it offers multiple profitable segments.

Palm Oil Value Chain Segments

Below is a simplified revenue structure:

| Value Chain Segment | Typical Profit Level | Notes |

| Fresh Fruit Bunch Farming | High | Year-round harvests |

| CPO Milling | Very High | Low production cost |

| PKO Extraction | High | Strong demand from cosmetics & industry |

| Refining (RBD) | High | Value-added products command premium prices |

| Fractionation | Medium–High | Produces olein/stearin |

| Biomass/Energy | Medium | Shell & fiber used as boiler fuel |

For Investors

Palm oil plantations generate stable revenue for 25–30 years once matured.

For Equipment Manufacturers

Each phase requires specialized machinery, creating multiple sales opportunities:

- Sterilizers

- Threshers

- Digesters

- Screw press

- Clarifiers

- Expellers

- Refinery lines

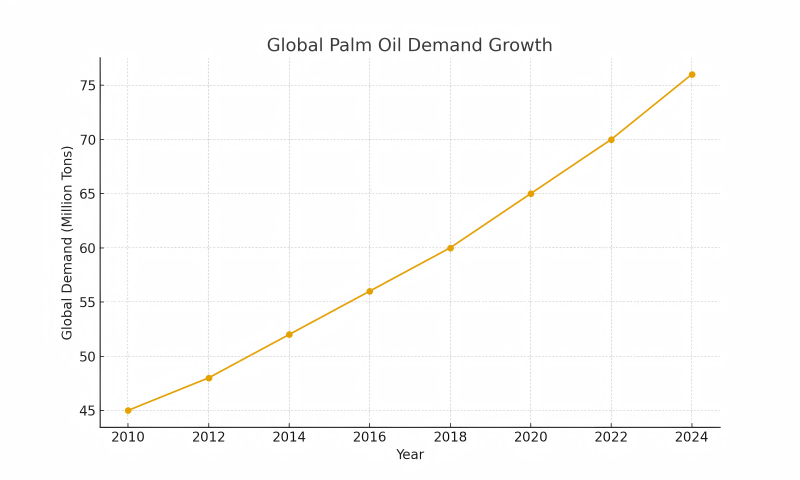

Reason 5: Export Growth Opportunities for Nigeria

Nigeria’s location and economic influence enable strong export potential.

Why Export Opportunities Are Growing

- International demand for sustainable palm oil is rising

- West African neighbors rely heavily on imports

- Middle Eastern and European buyers seek alternative supply routes

- Nigeria’s ports provide access to global markets

For Investors

High-margin markets include:

- RBD palm oil

- Stearin and olein

- Palm kernel oil

- Specialty oils

For Equipment Manufacturers

Nigeria can become a distribution hub for West Africa, expanding the market for machinery exports and after-sales services.

Reason 6: Technological Advancements Boost Productivity

Modern agricultural and processing technologies are transforming Nigeria’s palm oil sector.

For Investors

Technologies now enable:

- 90–95% oil extraction efficiency

- Reduced FFA (Free Fatty Acid) levels

- Remote farm monitoring

- Better quality output

For Equipment Manufacturers

There is high interest in:

- Automated presses

- Energy-efficient boilers

- Continuous sterilizers

- Advanced kernel crushers

- Modern refinery systems

This tech transition represents a multi-decade equipment market.

Key Challenges & Practical Solutions

While the sector is lucrative, investors must be aware of challenges.

Challenge 1: Land Acquisition

Solution: Partner with communities and utilize state land banks.

Challenge 2: Power Supply Weakness

Solution: Biomass boilers and solar hybrid systems reduce operating costs.

Challenge 3: Skill Shortages

Solution: Equipment suppliers can provide training and certification programs.

Challenge 4: Price Instability

Solution: Diversify into refined and specialty oils to stabilize revenue.

Investment & Equipment Cost Overview

For Investors: Typical Cost Breakdown

| Investment Component | Estimated Cost Range |

| Land Preparation (per ha) | Moderate |

| Seedlings (Hybrid) | Moderate |

| Plantation Establishment | High |

| 1–5 TPH Palm Oil Mill | Medium |

| 10–30 TPH Industrial Mill | High |

| Refinery Setup | High |

| Storage & Distribution | Medium |

ROI typically arrives in 3–5 years, depending on scale.

For Equipment Suppliers: Nigeria Market Opportunities

| Market Segment | Demand Level | Notes |

| Smallholder Mini-Mills | Very High | 1–2 TPH |

| Medium Industrial Mills | High | 5–10 TPH |

| Large-Scale Mills | Growing | 20–30 TPH |

| Kernel Crushing Plants | High | Strong PKO demand |

| Refining Equipment | High | FMCG-driven demand |

| Spare Parts & Service | Very High | Recurring revenue |

Palm oil production in Nigeria is not just profitable—it is strategically smart. With massive domestic demand, abundant land, strong government support, and high-margin value chains, the sector is poised for major growth. Investors benefit from stable, long-term revenue, while equipment manufacturers gain access to one of Africa’s largest and fastest-growing processing markets.

Nigeria’s palm oil sector is entering a new era of modernization, and those who move early stand to benefit the most.